Future & Options - Mastering Your Trading Techniques. This statistics fully support and resistance, Trend line, Candle sticks patterns. These and all changing your trading journey.

Mastering Your Trading Techniques

Welcome to journeyoftrading. I’m using only candlestick patterns, support and resistance, trend lines, and pivot points. These indicators are enough for a trading strategy. This strategy includes proper entry and exit and stoploss with trading psychology.

For Frequent updates and more informations follow my page.

Live chart analysis video uploaded for below youtube link

https://youtube.com/@journeyoftrading2024?si=-7rHkIf3g1U8ZWS7

Today we are going to discuss about Bank Nifty statistics date on 05/07/2024. Intraday means buying and selling same day. Its a high rewards & high risk. Intraday not only applicable for F&O. It’s using for stocks & swing Trading.

Two types of trading

· NRML – Normal

· Intraday Trading – “Margin Intraday Square-Off”

Traders are not closing their positions in portfolio, broker close automatically square off trade. This will not carrying forward the next day trading.Today market opening in gap down. Bank nifty chart morning defined down trend direction clearly. Easily find out the market directions, why because market opened for gap down.

Morning first candle is fake directions candle. Today High & yesterday low both zones are same. This zone reacted to resistance today. Same resistance line rejection already happened as on 28/06/2024 and 02/07/2024. Today its third time resistance line rejection happened. Not this only down trend direction, gap down also one more conformation given.

Some traders are take the entry for first candle. Its a inverted hammer, not probably buying direction. In case market open the gap up inverted hammer also one important candle. Now market opened gap down sellers only dominate/take off market control. Candle stick statistics applicable for all market chart like Indian market, forex currency, US markets etc… Bank Nifty chart above attached further below briefly explain… Today I got three entry of placing orders.

Types of Entry Points:

Three type of entry points today i got the entrys below mentioned.

1. Hanging Man (PE)

2. Inverted Hammer & Bullish Engulfing (CE)

3. Hammer (CE)

1.Hanging Man:

Hanging Man candle one type of bearish candle. When the market going up sellers are try to pull the market. Majority of candle sticks reactions will happen on support and resistance zone. This hanging man candle also formed on rejection zone/resistance zone. Bank Nifty chart below attached.

Hanging man next candle is shooting star, this candle break the today inverted hammer low point. Its a third conformation of put option (PE) entry. Previously I mentioned above preview of F&O Intraday statics content.

How to identify Before Buying Entry Conformations?

· First one yesterday low point rejections react to resistance zone.

· Second conformation hanging man candle.

· Third Conformation First candle low point broke.

When ever take the entry before (CE or PE) check the entry conformations. Its minimum two conformations required. Today the shooting star rejection happened on S2 support.

Now this resistance line when market going up it will react support. And when market going down it will react resistance line. This line will be same but reaction different. This down trend to be continue from S2 to S3.

S2 - Support 2

S3 - Support 3

This S3 one type of strong zone/buy zone. Not only for the S3 conformation it will discuss the next candle topics.

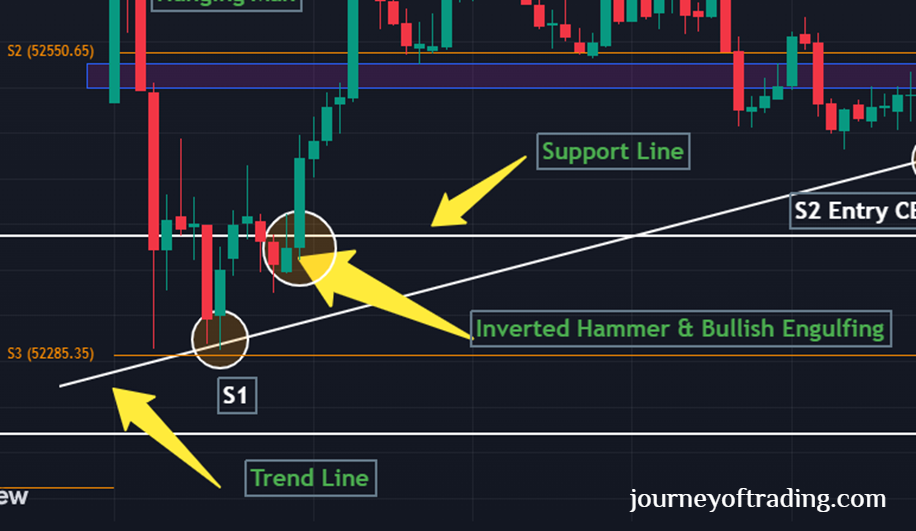

2.Inverted Hammer & Bullish Engulfing:

What is inverted hammer?

Hammer opposite directions is called inverted hammer. It’s a buyers candle/directions changing candle. When the market is going to down that time buyer came and try to push the market up side. Same scenario happened for today market. Bank Nifty Intraday chart below attached for your reference.

Here, market given for two conformation entry. One is inverted hammer, another one Bullish engulfing. Yesterday also I explained about bullish engulfing. Now the buyers are making inverted hammer & next conformation bullish candle. Now buyers dominating/buyers are take off the market control.

I will expect going up today first candle low points. Because it will react always support/resistance zone. My favourite candle sticks this also one. Bullish candle definitely dominate the market.

3.Hammer

Hammer is one of bullish identify candle. Here hammer candle given for triple conformations on today market. Hammer take a support with trend line S2 & S3. Here, market given for S3 (Support 3) with trend line, this rection bullish market identification. Bank Nifty chart attached for with example Hammer patterns.

Some traders are take a entry for assumption with out reading candle patterens. When the market is going up that traders take the entry from high level. You should wait, market again come for support level and going up. And you will get some profits more.

For Frequent updates and more informations follow my page.

Live chart analysis video uploaded for below youtube link

https://youtube.com/@ranjith142.?si=dz6UiNfzjNZNalz5

Leave a comment

Your email address will not be published. Required fields are marked *