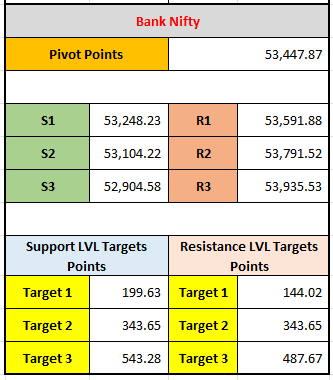

Bank Nifty Pivot Points for 12th December 2024: Key support and resistance levels are at 53,248.23 (S1), 53,591.88 (R1), with further targets at S2, S3, and R2, R3 for potential price movements.

The Pivot Points and Support/Resistance levels for Bank Nifty, which is an index representing the performance of major banking stocks in India. Pivot points and the corresponding support and resistance levels are commonly used by traders to gauge the potential market direction for the upcoming day. Here's an explanation of what these levels mean for 12-12-2024:

Pivot Point

- Pivot Point (53,447.87): This is the key level where the market may open and trend around. If the price is above the pivot point, the market sentiment is considered bullish. If the price is below the pivot point, it is considered bearish.

Support Levels

Support levels indicate where the price is expected to find buying interest (demand), preventing it from falling further.

- S1 (53,248.23): The first level of support. If the market falls, this is the first area where buying interest may come in to prevent further decline.

- S2 (53,104.22): The second level of support, representing a deeper level of potential buying interest.

- S3 (52,904.58): The third level of support, acting as a strong barrier against further drops. If this level is breached, there may be a strong bearish trend.

Resistance Levels

Resistance levels represent the price points where selling interest (supply) could emerge, potentially stopping the price from rising further.

- R1 (53,591.88): The first level of resistance. If the market goes up, this level will be the first point where sellers may take over, potentially reversing the price movement.

- R2 (53,791.52): The second level of resistance, where the price might encounter stronger selling pressure if it surpasses the first resistance.

- R3 (53,935.53): The third level of resistance, providing a higher ceiling for the price movement. If the market surpasses this, it could signal a strong bullish trend.

Support/Resistance Targets

These targets reflect the points traders aim for once certain support or resistance levels are breached:

- Support LVL Targets:

- Target 1 (199.63 points): If the price breaks the first support level (S1), a further decline of 199.63 points is expected.

- Target 2 (343.65 points): If the market drops further, a second target of 343.65 points below S1 could be the goal.

- Target 3 (543.28 points): This is the third target, signaling a deeper move if the price falls past S2.

- Resistance LVL Targets:

- Target 1 (144.02 points): If the price moves above the first resistance level (R1), the next target would be a rise of 144.02 points.

- Target 2 (343.65 points): If the price breaks through R1 and R2, the next resistance target is 343.65 points higher.

- Target 3 (487.67 points): The third resistance target indicates a higher potential move if the price surpasses R2.

Conclusion for Tomorrow:

- If the Bank Nifty index opens above the pivot point (53,447.87), it may be considered bullish, with the potential to test resistance levels (R1, R2, and R3). Targets for the day would be around 144 points to 487 points above the current price.

- If it opens below the pivot point, it could be a bearish day, with support levels (S1, S2, and S3) becoming key areas for a potential rebound. Targets for support would range from 199.63 to 543.28 points lower.

In essence, tomorrow's market action will largely depend on how the index behaves in relation to the pivot point and how it interacts with these support and resistance levels.

By using this information, traders can make informed decisions about where to place their buy or sell orders based on the expected market movement.

Leave a comment

Your email address will not be published. Required fields are marked *