Future & Options - Detecting Trading Trends. This statistics fully support and resistance, Trend line, Candle sticks patterns. These and all changing your trading journey.

Detecting Trading Trends

Welcome to journeyoftrading. I’m using only Candlestick patterns, support and resistance, trend lines, and pivot points. These indicators are enough for a trading strategy. This strategy includes proper entry and exit and stoploss with trading psychology.

For Frequent updates and more informations follow my page.

Live chart analysis video uploaded for below youtube link

https://youtube.com/@journeyoftrading2024?si=-7rHkIf3g1U8ZWS7

Now we are going to do chart analysis for the Bank Nifty on July 11, 2024. First I will Explain Market over view. Today, the market is open on Gap Up. Starting onward, the market goes down. Yesterday, resistance zones also reacted to resistance. Again, the market takes support from yesterday's support zones. It’s a fake support, and the market will fall again. This falling started from yesterday's 50% zone.

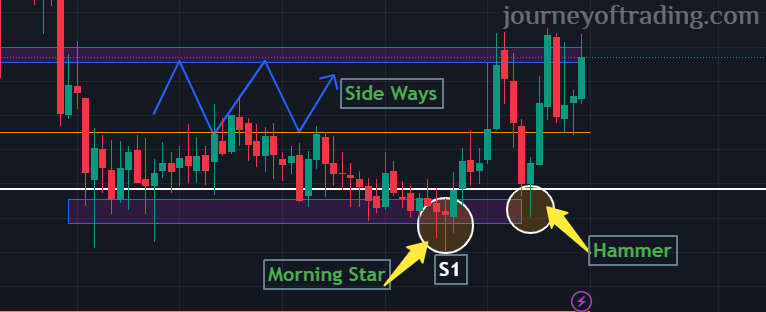

From morning on, sellers take off the market. It’s a good feeling. The premium price also moved up and booked a good profit. Again, the market takes fake support and fakes buying candles for hammers. It’s a totally down trend for the first half.

The market in between hours slightly slows down, like a sideways. But the market's second-half direction changed. Because the buyers take off the market. 21st June market has one resistance zone. But today, this resistance zone reacts to a strong buying zone.

Three rejections have already happened in this zone. Buyers strong candle formed of hammer. The second half of the of the market is a strong buying zone. This buying confirmation trend line with three supports I got. Specifically, I will explain this strong buying zone.

Today I got a one-put option and a three-call option entry. Briefly, I will explain them one by one. This entry is listed below.

1.Shooting Star

Shooting star It’s a strong-selling candle. Sellers dominate the market from morning onwards.

This shooting star formed from yesterday's resistance zone. This zone on 5th July , 8th July, and 9th July also reacts to the support zone. But from yesterday onwards, this zone reacted to the resistance zone. This is my first confirmation. And again, the market is down a little bit, taking support from yesterday's support zone.

Some traders take entries from the call option. They don’t know how the market reacted to resistance yesterday. Note this point yesterday market 50%. Now buyers give a little bit of movement; this confirmation candle is the morning star. This buyers go up to yesterday 50% zone.

Now the market control is taking off for the sellers. Now a big-selling candle formation has happened. It’s a bearish engulfing. This is a second confirmation of the put option entry. The option entry analysis below is mentioned.

This bearish, engulfing candle broke yesterday's support and yesterday's low. This low point is a second confirmation of the put options. Now the market is in a downtrend. It’s a good put option entry. In between one hammer, a fake candle formed; that’s not a buying confirmation. First half fully down trend, second half one good buying entry I got. I will explain the next topic.

Entry & Exit

Strike Price : 52,300 PE

Premium Buy Price : 391.70

Premium Sell Price : 658.20

Stop Loss : 294.55

Risk Points : 97.15

Reward Points : 266.55

2.Hammer

Hammer is the strong buying zone candle. Right now, we don’t know if the market is going up. This hammer candle is S1, and it is not a buying confirmation. It’s moving slightly up again as the bearish candle forms. This is also one fake candle on this topic, and I will explain the psychology part. Here, some traders take entries from the put option. It’s wrong because of the weak support zone the market has below.

This zone 21st June, 24th June react to resistance zone. But same line 25th June react to support zone. This support will continue today as well. How do I find this support zone?

Let you know that the above-mentioned hammer is Support 1 (S1). Now again, take a support from the same support line, trend line with hammer candle. It’s support 2 (S2). This is a little bit moving up to nearly 150 points. Chart analysis is attached below.

Entry and Exit

Strike Price : 51,800 CE

Premium Buy Price : 393.45

Premium Sell Price : 458.25

Stop Loss : 359.80

Risk Points : 33.65

Reward Points : 64.80

3.Morning Star

This candle has an important role to play in the market. It’s a strong buying candle. This candle takes support from a hammer fake candle bottom. The morning star takes trend line support with S3. This candle is going up, and yesterday's low point level was broken.

It’s a good moving uptrend. Now the buyers are only active on the market. The S1 and S2 comparatively S3 is strongest support. Sometimes the S1 supports only what we find out. Now the market is moving purely in upward directions. These cases blindly take the entry-call option.

Why? This Morning star candle has a perfect trend line with S3 support. This S3 support reached the opening point zone today. The chart analysis is also attached below.

Entry and Exit

Strike Price : 51,900 CE

Premium Buy Price : 366.00

Premium Sell Price : 589.90

Stop Loss : 340

Risk Points : 20

Reward Points : 223.5

And same day two morning star buying confirmation I got. This candle takes support from yesterday's low point. It’s a long, bullish candle. The second chart analysis below is updated.

Psychology part

Today, there is not that much fake candle formation. Because of clearly market direction found. The first half-down trend and the second half-up trend. But three psychological factors play a role. One is the morning star of the market opening time. And a hammer candle and bullish engulfing also formed; this is a fake candle.

Why? Because, in between, support is formed. I did not find out the market directions. Trading most of winning percentage is psychology.

Leave a comment

Your email address will not be published. Required fields are marked *