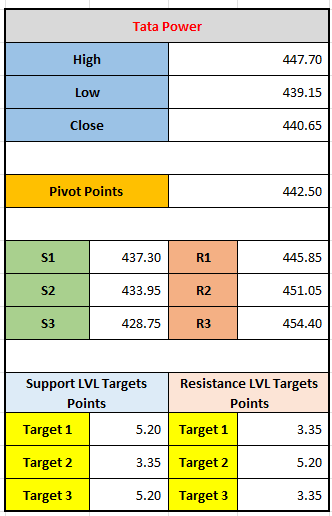

Analyze Tata Power's key pivot points, support, and resistance levels for potential price movements on December 9, 2024. Discover trading targets to plan your entry and exit strategies.

The stock information Tata Power, detailing its recent price action and pivot points. Here's a breakdown of the key data:

Price Action:

- High: ₹447.70

- Low: ₹439.15

- Close: ₹440.65

Pivot Points:

- Pivot Point: ₹442.50

- This is the central level around which the stock is expected to trade. If the stock price moves above this level, it could indicate bullish momentum; if it falls below, it could indicate bearish momentum.

Support and Resistance Levels:

- Support Levels (S1, S2, S3):

- S1: ₹437.30

- S2: ₹433.95

- S3: ₹428.75 These are levels where the stock is expected to find buying interest or support in case the price moves downward.

- Resistance Levels (R1, R2, R3):

- R1: ₹445.85

- R2: ₹451.05

- R3: ₹454.40 These levels represent points where the stock might face selling pressure if the price moves upward.

Target Points:

- Support Level Target Points:

- Target 1: 5.20 (This could be the potential movement range from the support level to the next resistance level or a target price).

- Target 2: 3.35

- Target 3: 5.20

- Resistance Level Target Points:

- Target 1: 3.35

- Target 2: 5.20

- Target 3: 3.35

The target points suggest potential price movements based on the support and resistance levels. These targets can be used to plan entry or exit points, depending on whether the stock moves towards the support or resistance zones.

Interpretation:

- Current sentiment: The stock closed near the pivot point of ₹442.50, indicating a balanced sentiment. If the stock moves above ₹445.85 (R1), it could show bullish momentum, targeting ₹451.05 (R2) or higher. Conversely, if it moves below ₹437.30 (S1), it could be a signal of bearish movement, with a target of ₹433.95 (S2) or lower.

By using this information, traders can make informed decisions about where to place their buy or sell orders based on the expected market movement.

Leave a comment

Your email address will not be published. Required fields are marked *