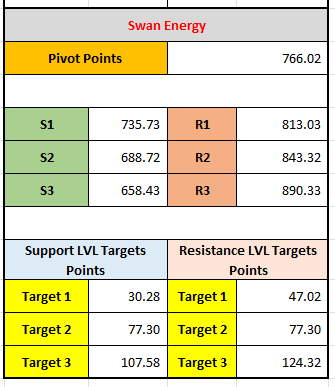

"Analyze Swan Energy's stock with key pivot points, support, and resistance levels for tomorrow. Understand the market forecast and potential price movements."

Based on the pivot points, support, and resistance levels for Swan Energy, here's an interpretation of how the stock might behave tomorrow 12-12-2024:

Pivot Points Overview:

- Pivot Point (766.02) is a key price level that traders use to determine market sentiment. If the price is above the pivot, the market is generally considered bullish (expecting upward movement). If the price is below the pivot, it is considered bearish (expecting downward movement).

Support Levels (S1, S2, S3):

These are levels where the price may find support, and the price could potentially bounce back if it falls to these levels:

- S1 (735.73): This is the first support level. If the price dips to this point, it could find support and potentially rise again.

- S2 (688.72): If the price moves below S1, the next support level is S2. This could be a stronger support point where buying interest may increase.

- S3 (658.43): This is the third support level, usually seen as a strong potential support if the price falls significantly below S2.

Resistance Levels (R1, R2, R3):

These are levels where the price may face resistance and could struggle to break through:

- R1 (813.03): The first resistance level. If the price rises and reaches this level, it may face selling pressure and could reverse or consolidate.

- R2 (843.32): If the price breaks through R1, the next resistance is R2. This level indicates a higher barrier for the price to break above.

- R3 (890.33): This is the third resistance level, and it represents a higher barrier to price movement. If the price surpasses this, it suggests a strong bullish trend.

Target Points for Support and Resistance:

Support Level Targets:

- Target 1 (30.28): If the price falls below the pivot point and starts moving towards lower support levels, Target 1 suggests it could test a lower point around 30.28.

- Target 2 (77.30): This is a higher support target, indicating a potential rebound or consolidation level if the price drops further.

- Target 3 (107.58): This is an even lower target for support, suggesting the possibility of a deeper correction if the market turns bearish.

Resistance Level Targets:

- Target 1 (47.02): This target suggests that if the stock rises, it could reach a resistance level at 47.02 as an early obstacle.

- Target 2 (77.30): Similar to Target 2 for support, this resistance target indicates that the price may meet resistance around this level if it continues to climb.

- Target 3 (124.32): This is the highest resistance level and may act as a key point if the price breaks through earlier resistance.

Market Outlook for Tomorrow:

- If the price is above 766.02 (Pivot Point):

- Bullish sentiment: The market could see upward movement, with the potential to test resistance levels.

- Targets for resistance: Prices may attempt to reach 47.02, 77.30, and even 124.32.

- R1, R2, R3 levels will be key to watch. The first resistance level is at 813.03, and if surpassed, the price could push towards 843.32 (R2) and 890.33 (R3).

If the price is below 766.02 (Pivot Point):

- Bearish sentiment: The price could trend downward, with support levels playing a crucial role in preventing further declines.

- Targets for support: The price may aim to test support levels at 735.73 (S1), 688.72 (S2), and even 658.43 (S3).

- Support targets: If the price falls lower, it could reach the lower support targets of 30.28, 77.30, or 107.58.

Key Focus Points for Tomorrow:

- Watch the pivot point (766.02) closely as it will help determine the market's direction. If Swan Energy stays above this level, resistance levels could be tested.

- Resistance targets are critical: If the price approaches 813.03 (R1) and faces resistance, it may struggle to go higher.

- Support levels will provide an opportunity for buying if the price declines, especially at S1, S2, or S3.

In summary, the market outlook for tomorrow hinges on the pivot point (766.02). If the stock trades above this level, the market may see upward momentum towards resistance targets. If it falls below the pivot, the stock could test lower support levels. Keep an eye on how the stock behaves around these levels for possible price action.

Top of Form

By using this information, traders can make informed decisions about where to place their buy or sell orders based on the expected market movement.

Leave a comment

Your email address will not be published. Required fields are marked *