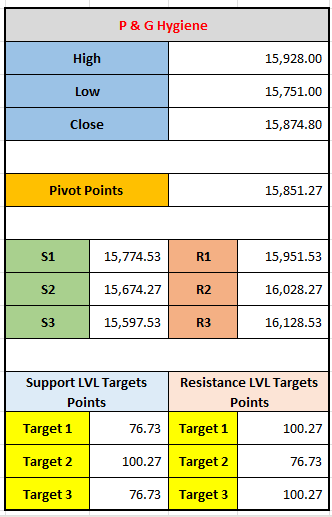

Stay updated with the latest technical analysis of P&G Hygiene stock as of December 9, 2024. Explore key resistance, support, and target levels to guide your trading decisions.

The technical analysis of the stock for P&G Hygiene (Procter & Gamble Hygiene), focusing on key price levels such as the high, low, close, pivot points, support, and resistance levels. Let me break down each part:

Key Price Data

- High: 15,928.00 – This is the highest price the stock reached during the trading period.

- Low: 15,751.00 – This is the lowest price the stock reached during the trading period.

- Close: 15,874.80 – This is the closing price of the stock at the end of the trading session.

Pivot Point

- Pivot Point: 15,851.27 – This is the primary level used to determine the overall trend. If the stock price is above this value, the market is considered to be in an uptrend, while below this level, the market is in a downtrend.

Support and Resistance Levels

These are the key price levels where the stock is expected to encounter barriers:

- Support Levels (S1, S2, S3): These are price levels where the stock is expected to find buying interest or "support":

- S1: 15,774.53

- S2: 15,674.27

- S3: 15,597.53

- Resistance Levels (R1, R2, R3): These are price levels where the stock is expected to face selling pressure or "resistance":

- R1: 15,951.53

- R2: 16,028.27

- R3: 16,128.53

Target Levels for Support and Resistance

- Support Target Levels:

- Target 1: 76.73

- Target 2: 100.27

- Target 3: 76.73

- Resistance Target Levels:

- Target 1: 100.27

- Target 2: 76.73

- Target 3: 100.27

The target levels seem to be points for potential price movements, indicating where the stock might reach in terms of support or resistance.

Interpretation

- Pivot Point Analysis: The pivot point (15,851.27) is a key indicator of the market's trend. If the stock closes above this value, it suggests an upward momentum, while closing below this could indicate a downward movement.

- Support and Resistance: The support levels (S1, S2, S3) represent potential price floors, where the stock may reverse direction if it falls to these levels. Resistance levels (R1, R2, R3) are where upward momentum could face barriers.

- Target Levels: These targets could reflect the projected price movement based on historical data or technical patterns. Support target levels represent where the stock might find buying interest, while resistance targets show where it might encounter selling pressure.

By using this information, traders can make informed decisions about where to place their buy or sell orders based on the expected market movement.

Leave a comment

Your email address will not be published. Required fields are marked *