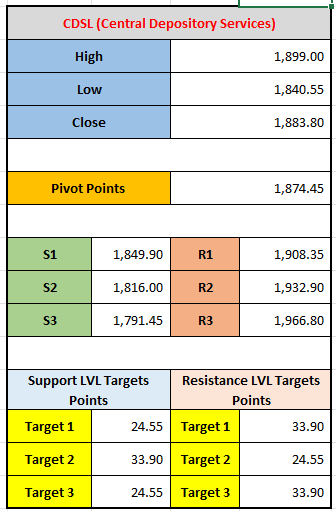

CDSL (Central Depository Services) closed at 1,883.80, with a high of 1,899.00 and a low of 1,840.55. The pivot point (PP) is 1,874.45, acting as the key reference level. Support levels (S1: 1,849.90, S2: 1,816.00, S3: 1,791.45) may provide buying interest. Resistance levels (R1: 1,908.35, R2: 1,932.90, R3: 1,966.80) could face selling pressure. Target points suggest possible movements: support ta

CDSL (Central Depository Services):

1. High, Low, and Close:

- High: 1,899.00 – This is the highest price CDSL reached during the trading session of yesterday.

- Low: 1,840.55 – This is the lowest price CDSL reached during the trading session of yesterday.

- Close: 1,883.80 – This is the final closing price of CDSL at the end of the trading session of yesterday.

2. Pivot Points:

Pivot points are used in technical analysis to predict potential market movement. The Pivot Point (PP) is calculated from the average of the high, low, and close prices, and serves as a key reference level.

- Pivot Point (PP): 1,874.45 – This is the central level from which the market can pivot (move up or down).

3. Support and Resistance Levels:

- Support Levels (S1, S2, S3): These are levels where the price might find buying interest (acting as a "floor"). If the price falls below the pivot point, it may find support at these levels:

- S1: 1,849.90

- S2: 1,816.00

- S3: 1,791.45

- Resistance Levels (R1, R2, R3): These are levels where the price may face selling pressure (acting as a "ceiling"). If the price rises above the pivot point, it may face resistance at these levels:

- R1: 1,908.35

- R2: 1,932.90

- R3: 1,966.80

4. Support and Resistance Target Points:

These targets represent the expected movement or range of price changes based on the support and resistance levels. They provide a sense of how far the price could move within the levels.

- Support LVL Targets Points:

- Target 1: 24.55 – The potential price movement down from the support level.

- Target 2: 33.90 – Another potential price move based on support.

- Target 3: 24.55 – Similar to Target 1, indicating the possible magnitude of price movement.

- Resistance LVL Targets Points:

- Target 1: 33.90 – The potential price move up from the resistance level.

- Target 2: 24.55 – Another possible price move based on resistance.

- Target 3: 33.90 – Similar to Target 1, showing potential movement upward.

By using this information, traders can make informed decisions about where to place their buy or sell orders based on the expected market movement.

Leave a comment

Your email address will not be published. Required fields are marked *