Future & Options - Achieving Mastery in Trading Techniques. This statistics fully support and resistance, Trend line, Candle sticks patterns. These and all changing your trading journey.

Achieving Mastery in Trading Techniques

Welcome to journeyoftrading. I’m using only candlestick patterns, support and resistance, trend lines, and pivot points. These indicators are enough for a trading strategy. This strategy includes proper entry and exit and stoploss with trading psychology.

For Frequent updates and more informations follow my page.

Live chart analysis video uploaded for below youtube link

https://youtube.com/@journeyoftrading2024?si=-7rHkIf3g1U8ZWS7

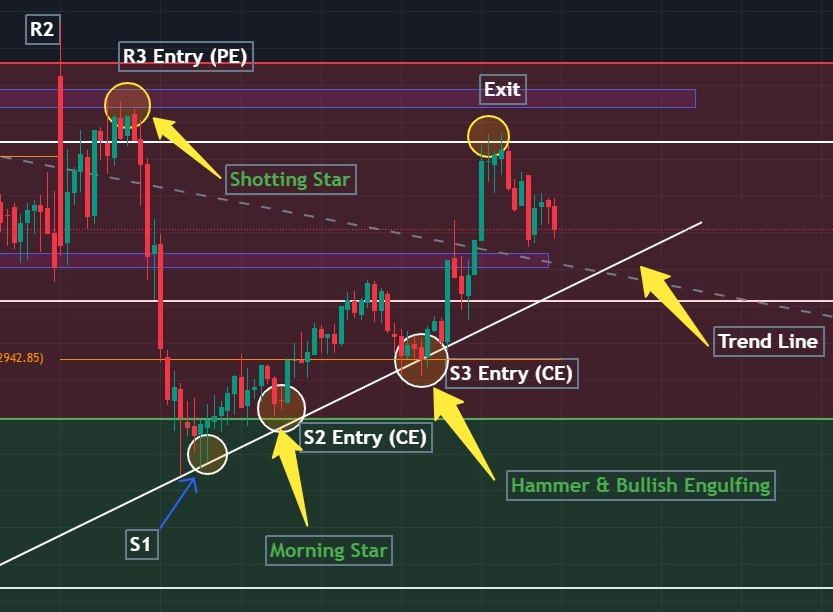

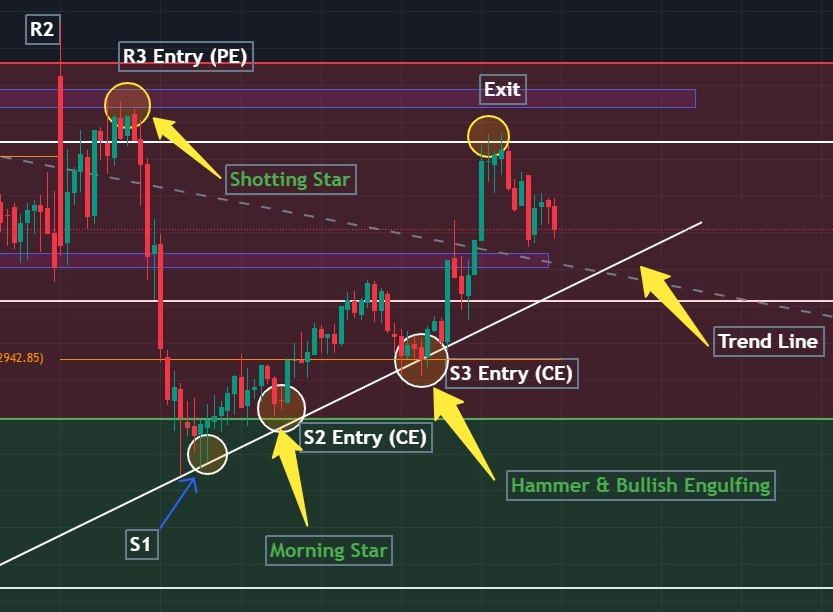

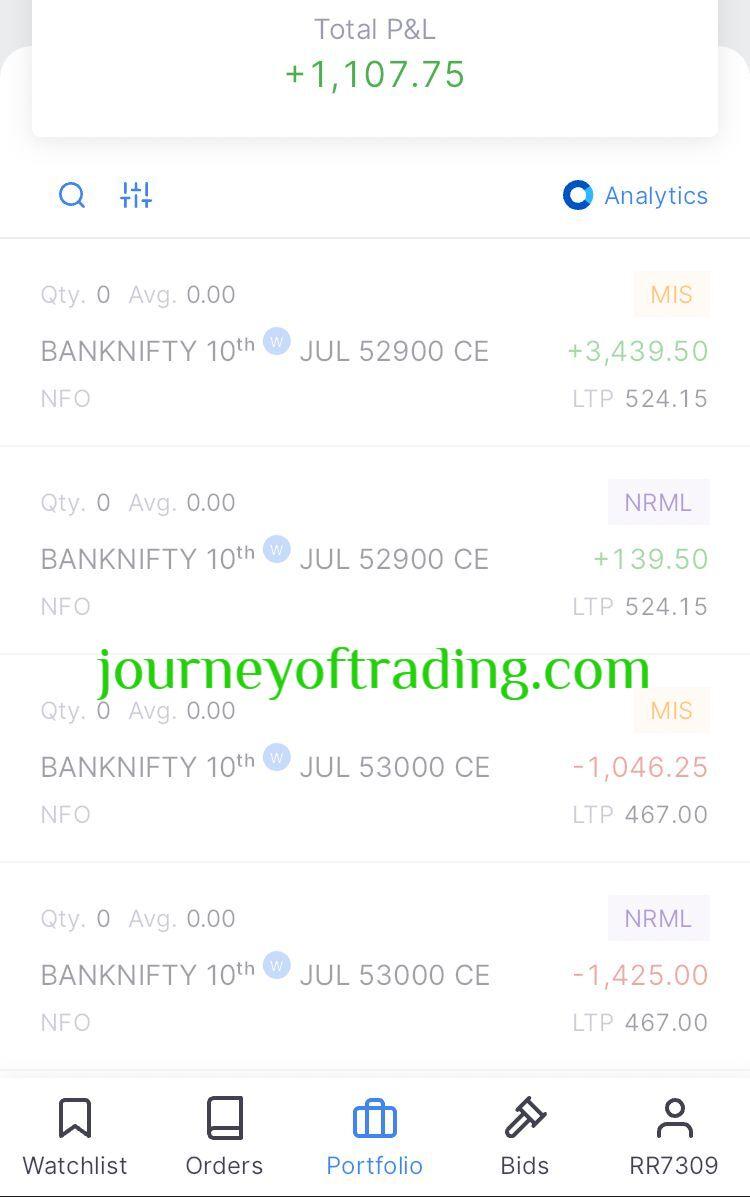

Today discussing about Bank Nifty chart Statics as on 04/07/2024. Today its opening on gap up and after the market react on reversal to down side starting onwards. Its fully slow movement. Bearish Engulfing candle formed. Some trader are take the entry for Bearish candle for Put options (PE). Its not down side conformation. Again it will going to up and touch the yesterday resistance zone. If candle break resistance zone market will go to upside. But market will not break the resistance zone. Again market gave the second conformation for down side Put option. Sellers start the dominating they make the shooting star candle. Morning onwards market down trend only. Now we are briefly analysis the candle sticks patterns. Today we have three entry points. One Put options and two call options entry.

Types of Entry Points candles:

1. Shooting Star (PE)

2. Morning Star (CE)

3. Hammer and Bullish Engulfing (CE)

1.Shooting Star:

Shooting star is one of important candles sticks for downside trend. Bearish candle rejection zone and shooting star zone both are same. One more thing is yesterday high point & today bearish candle rejection zone same. chart below attached for your reference.

Whenever you take the trade before one or two conformations required. Otherwise, don’t take the trade. Now Put option entry point shooting star (R3). Today first candle Low points break & It will going to down and break the today first candle. This down trend going to yesterday 50% reach after reversal will be happen. For your reference chart below attached.

Same as above discussed this point market reversal happened & Hammer candle formed (S1). Some traders are taken from entry here only. This is not accurate for all times. Previously I mentioned above point second conformation required.

2. Morning star:

This also most important candle specifically I refer for this candle. Because of Morning star candle formation after the market is buyers control. Buyers take off the market.

Above mentioned chart morning star take the support from trend line based. Trend line also one more conformation. Here three type of entry conformations got. For your reference chart below attached.

a) Morniing star candle

b) Yesterday 50% point support

c) Trend line support (S2)

3. Hammer & Bullish Engulfing:

Hammer candle support take from same trend line support (S3). Here also one entry for call option (CE) and three conformation.

a) Hammer & Bullish Engulfing

b) Trend line support (S3)

c) Morning star candle closing is here act on support

Now buyers are dominate and take off the market control. It will reach the today high point. If incase break the high point market will go up to up side. Here major role play for support, resistance & Trend line. We are analysis only this thing only.

For Frequent updates and more informations follow my page.

Live chart analysis video uploaded for below youtube link

https://youtube.com/shorts/4PiXAKDGJ5I?si=ye7-k_p-ro4-Wohg

Leave a comment

Your email address will not be published. Required fields are marked *