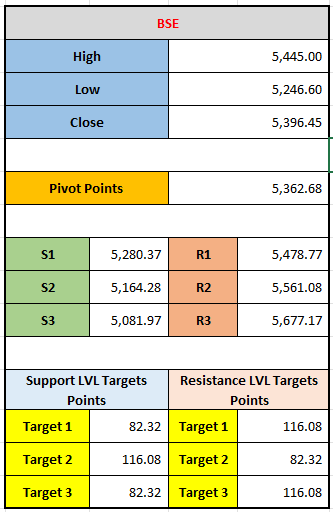

"Explore the key support, resistance, and pivot levels for BSE trading strategy on December 9, 2024."

The key technical indicators and levels used for analysis of the BSE (Bombay Stock Exchange) index, possibly for a specific trading day.

Key Price Levels:

- High: 5,445.00 — The highest price of the index during the trading day of yesterday.

- Low: 5,246.60 — The lowest price of the index during the trading day of yesterday.

- Close: 5,396.45 — The price of the index at the close of trading of yesterday.

Pivot Point:

- Pivot Points (5,362.68): Pivot points are used to determine potential support and resistance levels for the market. This value is calculated from the high, low, and close prices of the previous day and is considered the primary level for assessing market sentiment.

- The pivot point is often used as a reference point: if the market price is above this level, it suggests bullishness; if below, it suggests bearishness.

Support and Resistance Levels:

- S1 (Support 1): 5,280.37 — This is the first support level, where the price is expected to find support if it falls.

- S2 (Support 2): 5,164.28 — The second support level, further below S1.

- S3 (Support 3): 5,081.97 — The third support level, a deeper support zone.

- R1 (Resistance 1): 5,478.77 — The first resistance level, where the price may face selling pressure if it rises.

- R2 (Resistance 2): 5,561.08 — The second resistance level, further above R1.

- R3 (Resistance 3): 5,677.17 — The third resistance level, a higher resistance zone.

Support and Resistance Target Points:

- Support LVL Targets: These are suggested targets for support levels, likely indicating price points where the market could find stability or reverse its decline.

- Target 1: 82.32

- Target 2: 116.08

- Target 3: 82.32

- Resistance LVL Targets: These represent potential price points where resistance might occur.

- Target 1: 116.08

- Target 2: 82.32

- Target 3: 116.08

Key Observations:

- Pivot Points and Support/Resistance Levels (S1, S2, S3, R1, R2, R3) are used by traders to predict potential price movements and to set entry and exit points.

- Support Level Targets and Resistance Level Targets are typically used for short-term trading decisions, helping to identify potential buy or sell zones.

- However, there is redundancy in the Support and Resistance LVL Targets. The values for Target 1, Target 2, and Target 3 are repeating in a manner that is unusual for technical analysis. Normally, you'd expect these to represent different levels for both support and resistance, but here 82.32 and 116.08 are swapped for both support and resistance targets. It could be a mistake or simply an unusual way of presenting the information.

By using this information, traders can make informed decisions about where to place their buy or sell orders based on the expected market movement.

Leave a comment

Your email address will not be published. Required fields are marked *